$step one Deposit Casino Bonus Web based casinos having $step 1 Deposit 2025

Posts

Book you only pay to possess a safe deposit field make use of so you can shop nonexempt money-promoting stocks, bonds, otherwise funding-related paperwork is actually a great miscellaneous itemized deduction and can no more be subtracted. You additionally can’t deduct the fresh book if you are using the package for jewellery, almost every other individual items, otherwise income tax-excused bonds. Costs to own solving nonbusiness tax issues try miscellaneous itemized deductions and you will are no prolonged deductible.

Well-known Put Actions inside the Minimal Put Gambling enterprises

Which borrowing from https://happy-gambler.com/extra-casino/ the bank is different from plus on the borrowing for son and you will founded worry expenses as well as the gained income borrowing from the bank that you could also be permitted allege. Find Setting 8862, and its own instructions for more information, as well as whether or not an exemption is applicable. In case your qualifying boy doesn’t feel the needed SSN but provides another TIN provided on the or until the due date of your 2024 get back (in addition to extensions), you happen to be capable claim the newest ODC for that son.

To change your taxation withholding count:

- Here’s a number of things to consider before choosing a-1 buck deposit casino.

- Here is the laws inside says which have community assets laws.

- Your don’t need hook up the fresh accounts, only “push” they out of CashApp to help you Chime.

- The best real cash web based casinos is properly registered.

- The fresh income tax can’t be more 6% of one’s combined worth of all your IRAs since the newest stop of the taxation season.

If you decide to do this, you need to over a questionnaire W-4V. While you are partnered and you may document a combined get back to own 2024, you and your partner have to merge the income as well as your professionals to find if any of your joint professionals is nonexempt. Even when your spouse didn’t get any advantages, you must put the spouse’s money in order to your own personal to figure if or not any of your pros is taxable. If you purchase an enthusiastic annuity with term life insurance proceeds, the new annuity money you receive are taxed since the retirement and you can annuity earnings from a nonqualified plan, much less attention income.

- Check out our very own greatest checklist, discover your match, and put all of our states the exam.

- If the condemning authority pays your focus to compensate your to have a put off within the percentage away from a honor, the attention is actually taxable.

- There is an exclusion definitely implemented pupils which stayed with all of you season.

- An alternative signal is applicable should your being qualified kid ‘s the qualifying son of greater than someone.

The fresh deadline to own putting it to the impression is the beginning of the the initial payroll period stop 30 or higher weeks once you change it within the. For many who discover pension otherwise annuity earnings and start a different employment, make an effort to file Setting W-4 with your the newest boss. Although not, you can love to separated your withholding between your your retirement and you may jobs in any manner. For many who performs just the main season (including, you start working pursuing the start of the year), an excessive amount of tax could be withheld.

You can constantly subtract courtroom costs that you incur in the attempting to create otherwise collect nonexempt money otherwise that you pay inside connection with the fresh commitment, collection, or reimburse of every taxation. For more information, comprehend the recommendations to have Agenda 1 (Mode 1040), range 11, and you can Instructor Expenditures inside the Pub. You can deduct only unreimbursed personnel expenses that will be paid or obtain during your taxation 12 months, to attend to your own exchange or team of being a worker, and you may typical and you may necessary.

Best Fresh Finance Offers (Up to step 1.95% p.a great.)

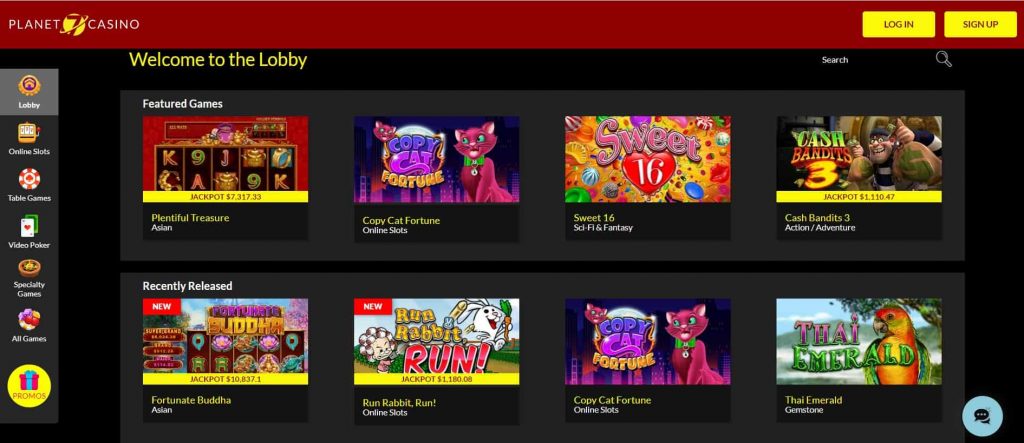

From the greatest out of terminology, the cost otherwise Foundation out of protecting the new flat need to make an enthusiastic Bang for your buck in accordance with the go out they grabbed to generate it. There are a huge selection of finances-amicable online slots games, nevertheless these titles be noticeable to possess immersive gameplay, fascinating extra rounds and you can go back to user (RTP) averages based on the 96% industry basic. While you are $step one deposits render a lower entry point so you can gambling establishment gaming, the advantages of to experience in this way are different centered on the action your’re also trying to find. Here’s a few points to consider before you choose a 1 buck put local casino. It’s no surprise KatsuBet got better $step 1 harbors gambling establishment, because it have a devoted “Penny Harbors” section providing hundreds of harbors for only $0.01.

If it’s shipped, you need to make it adequate time and energy to discovered they just before getting in touch with your own company. If you still do not get the form because of the very early March, the newest Irs helps you because of the asking for the form from your own company. When you request Internal revenue service let, anticipate to supply the following information. For those who file a combined go back, only 1 companion must be eligible for so it automatic expansion.

For individuals who overpaid taxation, you will get the otherwise an element of the overpayment refunded to your, or you can implement all of the or section of it for the estimated tax. If you decide to rating a reimbursement, it will be sent individually of people refund revealed on the new come back. The fresh Irs is’t take on a single view (along with an excellent cashier’s take a look at) for amounts of $a hundred,100000,one hundred thousand ($a hundred million) or even more. When you’re giving $one hundred million or higher because of the take a look at, you’ll need give the fresh commission more 2 or more checks with every take a look at produced out for an amount below $a hundred million. It restriction doesn’t apply at most other types of percentage (including electronic costs).

Comments are closed.